[

](https://substackcdn.com/image/fetch/$s_!xfgS!,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F8c9b3475-f17f-475e-9cdf-8bfab198a0ef_1456x816.png)

When the market goes silent, it’s telling you something

You’re watching a company receive regulatory approval worth tens of millions of dollars. The announcement hits the newswires. Analysts scramble. And the stock price... does nothing. Zero movement. Not a tick upward, not even a slight drift. The market, that relentless machine of profit-seeking and pattern-recognition, absorbs news that should be material-news that fundamentally alters the company’s cost structure-and yawns.

Now watch what happens when a different company, structurally identical, receives the exact same approval for the exact same product. The stock surges 2%. In five days, shareholders are $51 million richer. The market, suddenly awake, reprices the firm as if it had just discovered oil.

This bifurcation-this split between silence and celebration-is not random noise. It is a confession written in the language of capital. And for the first time, researchers have learned to decode it.

The Silence That Speaks

Between 2018 and 2020, the U.S. government imposed tariffs on approximately $550 billion of Chinese imports, creating one of the largest regulatory shocks in modern economic history. To prevent “undue harm” to American businesses, the Office of the U.S. Trade Representative established an exemption process. Firms could petition to have specific products excluded from the 20-25% duties. Out of 53,000 applications, only 14.6% were approved.

The stakes were extraordinary. For a typical firm importing $100 million in goods annually, an exemption was worth $20-25 million in saved costs every year. Multiply that by the uncertainty of the trade war’s duration, and you’re looking at regulatory decisions that could add or subtract hundreds of millions from a company’s market value.

The question was simple: Who got approved?

The answer turned out to be mathematically elegant and politically devastating.

Quantifying Favoritism Through Return Differentials

When researchers analyzed the stock market’s reaction to 7,015 exemption decisions, they documented something unprecedented: the market had already identified which firms would receive favors before the government officially announced them.

The statistical signature is unmistakable:

For unconnected firms receiving approval:[

](https://substackcdn.com/image/fetch/$s_!ncVF!,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F9f0264cf-dea8-400b-9f40-41f2d7a4510a_1344x118.png)

For politically connected firms receiving approval:[

](https://substackcdn.com/image/fetch/$s_!_ib-!,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F5236f164-ed55-44e9-9333-a6bfc92960a8_1370x122.png)

Where CAR is the cumulative abnormal return-the price movement that cannot be explained by broader market trends.

This is not a rounding error. For a firm with a $10 billion market capitalization, we’re comparing a $218 million surprise windfall against... nothing. The market had already priced the favor into the connected firm’s valuation months or years earlier. When the exemption arrived, it was merely the confirmation of a bet already placed.

The Mechanism: Campaign Contributions as Predictive Signals

Here is where the mathematics of corruption becomes precise.

The researchers used probit regression to isolate which variables predicted exemption approval, controlling for the stated merit criteria: economic harm to the applicant, availability of substitute products, and strategic importance to Chinese industrial policy. After accounting for these legitimate factors, political connections remained the dominant predictor.

The partisan effect:

One standard deviation increase in Republican PAC contributions →+3.94 percentage pointincrease in approval probability

One standard deviation increase in Democratic PAC contributions →-3.40 percentage pointdecrease in approval probability

With a baseline approval rate of 14.6%, these effects represent a 27% boost for Republican donors and a 23% penalty for Democratic donors. This is not correlation buried in noise. This is signal.

And here is the crucial detail: these donations were made during the 2016 election cycle, two years before the tariffs were even imposed. The political capital was established long before the regulatory shock arrived. Reverse causality-the possibility that firms donated after receiving favors-is ruled out by the timing alone.

The Placebo That Proves Intent

If you want to distinguish between a corrupt system and an unlucky one, you run placebo tests. You apply the same analysis to a scenario where favoritism should not exist, and you verify that the pattern disappears.

The Section 232 steel and aluminum tariff exemptions, administered by the Department of Commerce with Inspector General oversight and Congressional reporting requirements, provide the perfect control group. When researchers analyzed those applications using identical methods, they found:

**Political contributions:**No statistically significant effect on approval. **Lobbying expenditures:**No statistically significant effect on approval. **Market returns:**No systematic bifurcation between connected and unconnected firms.

The favoritism vanished when institutional guardrails were present. This is what proves that the Section 301 pattern was not an artifact of “better firms donate more” or “connected firms file better applications.” It was a function of regulatory architecture-specifically, the absence of oversight.

The Democratic Penalty: Retaliation as Proof

The most damning piece of evidence is not that Republican donations helped firms. It’s that Democratic donations hurt them.

If political connections were simply buying information or access to better lawyers, donations to the minority party should have a neutral effect at worst. Instead, they carried an active penalty. Firms that contributed to Democrats during the 2016 cycle saw their approval odds drop by 3.4 percentage points-nearly as large in magnitude as the Republican bonus.

This is incompatible with any benign explanation. It cannot be explained by application quality (why would partisan affiliation correlate with bureaucratic competence?). It cannot be explained by industry selection (the effect persists within product-level comparisons). It can only be explained by retaliation: the deliberate withholding of regulatory relief to punish supporters of the political opposition.

When Markets Anticipate Corruption

The efficient market hypothesis states that asset prices reflect all available information. But what happens when some of that information is illegal to act upon, or at least morally corrosive to acknowledge?

Consider the timeline from the market’s perspective:

**T₀ (2016):**A firm makes substantial PAC contributions to Republican candidates. **T₁ (November 2016):**Republicans win the presidency. **T₂ (2018):**Tariffs are announced, creating regulatory discretion. **T₃ (2019):**The firm applies for an exemption. **T₄ (2020):**The exemption is granted.

At which point does the market price the favor? The evidence suggests T₁ or T₂-long before T₄. By the time the USTR posts its approval notice to the Federal Register, sophisticated investors have already concluded that this firm’s political capital makes success highly probable. The approval itself contains no new information.

This is why connected firms show zero abnormal returns. The “news” was already baked into the stock price. The favor was priced in at the moment the political investment paid off electorally, not at the moment the bureaucratic machinery confirmed it.

The Information Channel Dies in the Details

Critics of the favoritism interpretation often invoke the “information channel”: perhaps lobbying simply helps firms communicate complex technical details to regulators, and campaign contributions are just a way to buy access to that communication pathway.

This hypothesis makes testable predictions. If lobbying were primarily informational, applications with professional representation should be processed faster (less time needed to clarify details) and the partisan composition of donations should be irrelevant (information quality is not ideological).

Neither prediction holds.

The USTR tooklongerto process applications from firms with professional lobbyists-an average of several additional weeks. This suggests that lobbying increased the informational density of submissions, requiring more administrative scrutiny. So far, the information channel looks plausible.

But then the Democratic penalty obliterates it. If the USTR were using lobbying to gather information, why would donations to the minority party actively harm a firm’s application? The information provided would be identical. The technical details about supply chain dependence and economic harm don’t change based on the partisan affiliation of the donor.

The retaliatory effect is the “smoking gun” that proves quid pro quo. Regulators were not just passively benefiting from information; they were actively rewarding friends and punishing enemies.

The GAO Audit: Institutional Failure as Enabler

In 2021, the Government Accountability Office published a scathing report on the Section 301 exemption process. After reviewing thousands of applications, GAO investigators documented:

No documented internal proceduresfor adjudication

No justification providedfor the majority of decisions

Inconsistent applicationof stated criteria

No formal appeal process

No Congressional or Inspector General oversight

Identical applications-same product, same harm arguments, same substitute availability-received opposite outcomes. The USTR’s binary decisions (”Approved” or “Denied”) came without explanation, creating what the GAO called “undue influence” risk.

This opacity was not a bug. It was the environment in which favoritism thrives. When a regulatory process lacks a transparent rubric, the vacuum is filled by political considerations. The market, sensing this lack of procedural rigor, relied on political proximity as the only consistent signal for predicting outcomes.

The Section 232 comparison confirms this causal story. When institutional guardrails exist-Inspector General monitoring, Congressional reporting, transparent criteria-political connections lose their predictive power. The corruption is not inherent to trade policy or to American government. It is a function of discretionary authority operating in the absence of accountability.

The Welfare Cost of Politicized Relief

This is not just an academic exercise in detecting favoritism. The misallocation of exemptions has real economic consequences.

Research on the American Recovery and Reinvestment Act provides a parallel: when stimulus funds were channeled through politically connected firms, the local jobs multiplier dropped by 7.1 jobs per million dollars spent. Connected firms were not necessarily the most efficient or best positioned to expand employment; they were simply the best at securing government grants.

The tariff exemption regime created a similar distortion. The $57 billion in market capitalization generated by approved exemptions was not distributed to the firms that needed relief most or could deploy it most productively. It was distributed to the firms that had invested in political capital.

When unconnected firms-likely more efficient competitors-received exemptions, their stock prices surged 2-3%, indicating that the market had severely discounted their survival odds. These firms were being selected against by a political process, even though their economic fundamentals may have been superior.

The trade war as a whole imposed $48 billion in annual costs on American consumers while creating an estimated 8,700 jobs in protected industries-a cost of $650,000 per job. By layering a partisan spoils system on top of this already-inefficient policy, the USTR ensured that even the “relief” from the harm was allocated based on political loyalty rather than economic need.

The Methodology: A Template for Detecting Future Corruption

What makes this analysis powerful is not just that it documents favoritism in one historical episode. It demonstrates a replicable methodology for detecting corruption in any discretionary regulatory system.

The recipe has four components:

1. Identify a high-stakes regulatory decisionwhere government officials have significant discretion and outcomes can be objectively measured (approved/denied, granted/rejected).

2. Document the political connectionsof affected firms prior to the regulatory shock, using campaign finance records, lobbying disclosures, and revolving door employment data.

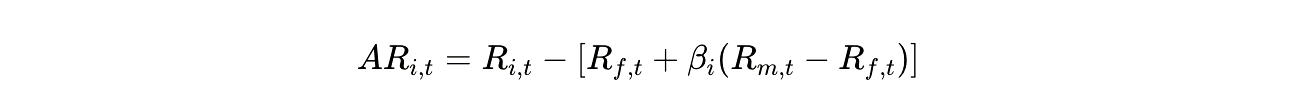

3. Measure market reactionsto decisions using event study methodology, calculating abnormal returns that isolate the surprise component:[

](https://substackcdn.com/image/fetch/$s_!Lmn9!,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F58ee23c3-c4f3-4b63-bda9-41613e11f28f_1316x112.png)

where AR is abnormal return, R is actual return, Rf is risk-free rate, β\beta β is firm-specific market exposure, and RmR_m Rm is market return.

4. Run the placebo suite:

Institutional placebo (apply to oversight-heavy programs)

Partisan placebo (test out-of-power donations)

Geographic placebo (test state vs. federal alignment)

Timing placebo (test leads and lags)

If the pattern survives all four tests, you have documented systematic favoritism. The market’s differential response-silence for connected firms, surprise for unconnected ones-is the mathematical signature of priced-in corruption.

The 2025 Escalation: A Real-Time Test

On April 2, 2025-dubbed “Liberation Day” by the administration-President Trump announced sweeping reciprocal tariffs: a 10% baseline on nearly all imports, with country-specific rates climbing as high as 34% for China. The policy extended the Section 301 discretionary framework to virtually every trading partner.

The market reaction was immediate and stratified. Firms with deep supply chain exposure to China saw valuations drop 5-10% in the days following the announcement. But within that broad decline, a familiar pattern emerged: firms with established political connections to the administration experienced smaller losses. The market was already pricing which companies would successfully navigate the new exemption process.

This is the methodology in action. We don’t yet have the complete data on who receives exemptions under the 2025 regime-those decisions will unfold over months. But by monitoring stock price movements at both the announcement of political investments (lobbying hires, major donations) and the subsequent regulatory decisions, researchers can construct a real-time audit of favoritism.

If connected firms show muted reactions to approvals while unconnected firms show large positive surprises, we will have detected the same pattern repeating. The market will have documented, once again, that regulatory relief is allocated based on political loyalty rather than economic merit.

The Confession That Cannot Be Denied

When prosecutors build a case, they look for evidence that the defendant cannot explain away. Bank records that show cash flows on specific dates. Video footage timestamped to the minute. Communications intercepted and preserved.

The stock market provides something similar: a continuous, high-frequency record of investor beliefs, backed by billions of dollars in capital at risk. When those investors systematically price political connections as the primary determinant of regulatory outcomes-so reliably that they stop reacting to the outcomes themselves-they are confessing what they observe.

This confession is involuntary. No trader sets out to document corruption. They are simply trying to make accurate predictions about which firms will be helped or harmed by government policy. But in doing so with extraordinary precision, they create an evidentiary trail that is nearly impossible to dismiss.

You cannot argue that markets are inefficient or that traders are conspiracy theorists when their predictions are borne out at scale. You cannot argue that political connections are irrelevant when the market consistently prices them as the dominant variable. And you cannot argue that the system is merit-based when the Section 232 placebo-identical methodology, oversight-heavy process-shows no political effect at all.

What We’ve Learned to Read

The title of this investigation is a statement of fact: the market is involuntarily documenting corruption in real-time, and we have learned how to read it.

The technical innovation is the bifurcation analysis-the recognition that in an efficient market, theabsenceof a price reaction to good news is itself informative. When a connected firm receives a valuable regulatory favor and the stock price doesn’t move, it means investors already knew the favor was coming. The certainty was already reflected in the valuation.

The methodological innovation is the placebo suite-the systematic testing of alternative explanations through institutional comparisons, partisan reversals, geographic mismatches, and timing leads. Each placebo eliminates one benign hypothesis until only the corruption hypothesis remains standing.

The practical innovation is the scalability. This methodology can be applied to any regulatory domain where:

Officials have discretion

Political connections are observable

Outcomes are consequential enough to move stock prices

A control group exists where favoritism should not operate

That describes pharmaceutical approvals, defense contract awards, infrastructure project selections, environmental permit decisions, and dozens of other arenas where government power intersects with private capital.

The Permanent Audit

For decades, the detection of political corruption has relied on investigative journalists cultivating sources, prosecutors flipping witnesses, and whistleblowers risking careers. These methods remain essential. But they are labor-intensive, case-specific, and often arrive too late to prevent the harm.

The market-based audit operates continuously, requires no special access, and is nearly impossible to suppress. As long as securities are publicly traded and campaign finance records are disclosed, researchers can construct this test. The data is already being generated every trading day. We just had to learn what it was telling us.

This does not mean the market is a moral actor. Investors do not trade on political connections because they disapprove of corruption-they trade on them because corruption is predictable and therefore profitable. The market is amoral. But that amorality makes it a reliable witness. It has no incentive to lie about what it observes.

The Unanswered Question

The evidence for systematic favoritism in the Section 301 exemption process is now beyond reasonable dispute. The bifurcation in abnormal returns, the partisan asymmetry in approval rates, the retaliation against opposition donors, the disappearance of political effects under oversight-each of these findings is statistically robust and survives extensive testing.

But one question remains: Will anyone care?

The USTR officials who administered the exemption process have moved on to other roles. The firms that received favorable treatment collected their windfalls. The firms that were denied have adjusted their supply chains or absorbed the costs. The political donations that purchased the outcomes are protected by the First Amendment. And the market, having correctly identified the pattern, has already moved on to pricing the next regulatory shock.

Perhaps that is the most disturbing implication of this research. The confession is written plainly in the stock price data. The methodology is replicable. The pattern will almost certainly repeat in the next high-discretion regulatory program. And yet, the system persists because the beneficiaries of favoritism are also the ones who fund campaigns, staff administrations, and write the rules that govern their own oversight.

The market documents the corruption. But markets don’t reform governments. People do.